GO2 for Lung Cancer, Dana-Farber Cancer Institute, and Addario Lung Cancer Medical Institute Announce Expansion of Landmark Patient Research on Underlying Causes of Inherited Risk of Lung Cancer

Clinical Trial Aims to Unlock the Origins of Lung Cancer WASHINGTON and BOSTON, April 17, 2024 – In a promising step forward, GO2 for Lung Cancer (GO2), Dana-Farber Cancer Institute (Dana-Farber), and the Addario Lung Cancer Medical Institute (ALCMI), GO2’s medical research consortium, announced a major expansion of landmark [...]

Fern Halper, Ph.D., Appointed to GO2 for Lung Cancer Board of Directors

Brings background in data, AI, and analytics to help guide research collaboration and improved patient outcomes WASHINGTON, April 15, 2024 — GO2 for Lung Cancer (GO2) announced that the organization elected Fern Halper, Ph.D. to its board of directors. Halper is vice president and senior director of TDWI Research for advanced [...]

From Patient to Advocate: David’s Story

David lives in Arlington, VA, with his wife, Lisa, son, Ethan (6), and daughter, Liv (3). He is a passionate supporter of the Baltimore Ravens, Washington Capitals, Baltimore Orioles, and Penn Men’s Lacrosse, of which he was captain in 2007. He and his wife are in the process of [...]

GO2’s 5K Walk/Run Series Welcomes the White Ribbon Project

We are excited to welcome the White Ribbon Project as a 2024 5K walk/run partner. Representatives from the White Ribbon Project will be on-site at our 5Ks to share their important mission and distribute white ribbons to community members who would like to help raise awareness about the disease. We [...]

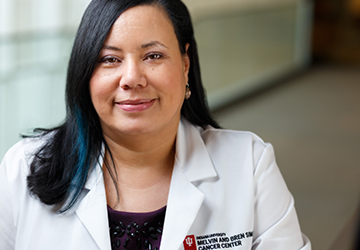

Ask the Experts: Women and Lung Cancer

Question: My daughter was just diagnosed with lung cancer at the age of 35. Her doctor told us that many young women are now getting lung cancer. Why is this? (Answered by Dr. Narjust Florez from the Dana-Farber Cancer Institute during her appearance at the February 2024 Lung Cancer [...]

Ask the Experts: Radiation Therapy

Question: My mom was recently diagnosed with lung cancer, and her healthcare team recommended radiation as part of her treatment. We don’t know much about radiation yet. What are the different types of radiation therapy, and how are they given? Is it difficult to deliver radiation to a tumor [...]

2024 Lung Cancer Support Group Facilitator Awardee, Christine Conti

Congratulations to our 2024 Lung Cancer Support Group Facilitator award recipient, Christine Conti, from Huntington Health in Pasadena, California. This award, given annually since 2009, recognizes the uncommon dedication of support group facilitators. Christine Conti, RN, ONN-CG, is a thoracic nurse navigator who has been Huntington Health’s lung cancer support [...]

“My Job is More Than a Job”

Author: Meg Fay, BSN, RN, Nurse Manager, Excellence in Healthcare Delivery, GO2 for Lung Cancer My name is Meg, and I had the pleasure of experiencing the NYC Marathon 2024 as part of the GO2 Endurance Team. Coach Seth guided our team, offering multiple training programs that we could tailor [...]

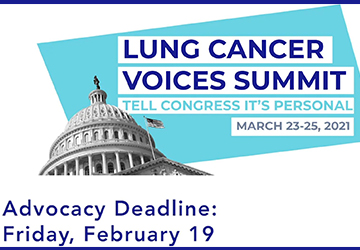

2024 Lung Cancer Voices Summit Recap

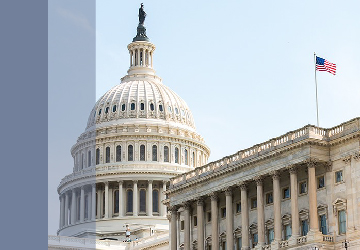

GO2 for Lung Cancer’s Voices Summit is the only annual meeting that brings the lung cancer community together for education, training, connection, and advocacy action with our federal government, the largest funder of cancer research. This month, nearly 200 advocates from 31 states gathered in Washington, D.C., for the [...]

How One Survivor Became an Advocate: Perspectives from a Voices Summit First-Timer

Earlier this month, Oakland-based photographer Genevieve joined nearly 200 other lung cancer advocates in Washington, D.C., to share her story with Congressional members and urge support for lung cancer research. We talked to her about her experience as one of 109 first-time participants at the GO2 for Lung Cancer [...]

Living Room Show Notes: Women and Lung Cancer

Women living with or at risk for lung cancer often have different, and sometimes worse, experiences than men with the same disease. This is due in part to biological differences between men and women and in part to the historical exclusion of women in clinical trials. This has resulted [...]

Ask the Experts: What Does it Mean to Develop Resistance to Treatment?

Question: I was recently diagnosed with lung cancer and am on my first line of treatment. I keep hearing that at some point I may develop a resistance to that treatment. What exactly does that mean and how long might I have before resistance develops? (Answered by Dr. Jyoti [...]

Mary’s Lung Cancer Story: It Doesn’t Stop You From Living

For people diagnosed with lung cancer, receiving a second opinion can be an important step in confirming treatment decisions or opting for a new approach to treatment. In Mary Burlie’s case, getting a second opinion changed everything. Although her first oncologist did not believe that Mary’s lung cancer had [...]

FDA Approves Rybrevant (amivantamab-vmjw) for Non-small Cell Lung Cancer with EGFR-Exon 20 Mutation

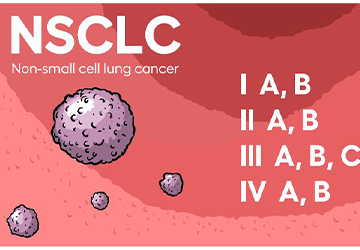

On March 1, 2024, the U.S. Food and Drug Administration (FDA) approved the drug Rybrevant (amivantamab-vmjw) to be given in combination with carboplatin and pemetrexed in the first lining setting for people with metastatic non-small cell lung cancer (NSCLC) with an EGFR exon 20 mutation. They also announced traditional approval [...]

GO2 for Lung Cancer Holds Lung Cancer Voices Summit on Capitol Hill to Advocate for Increased Research Funding for the Leading Cause of Cancer Death

More than 230,000 Americans will die of lung cancer this year WASHINGTON, March 4, 2024 - On Tuesday, March 5 GO2 for Lung Cancer (GO2) will host more than 200 supporters on Capitol Hill to educate members of Congress on the urgent needs of the lung cancer community. GO2’s Lung Cancer [...]

Meet HealthUnlocked’s “Denzie:” Celebrating 13 Years of Survival

If you have spent any time in GO2’s online support community, HealthUnlocked, you have likely come across posts, advice or support from a member who calls herself “Denzie.” Denzie volunteers as a dedicated moderator, welcomes new users, answers questions and provides encouragement and comradery to [...]

Ask the Experts: What’s New in SCLC Research?

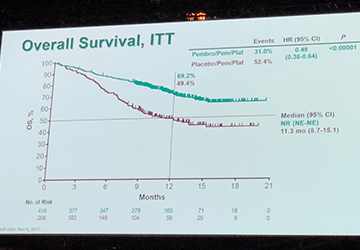

Question: I have small cell lung cancer (SCLC). What’s new in research related to SCLC? What should I know about clinical trials? (Answered by Dr. Jacob Sands from Dana-Farber Cancer Institute during his appearance on the Lung Cancer Living Room. It has been edited slightly for this use.) Answer: [...]

Finding Hope in an ALK+ Diagnosis

Craig S. lives in Washington, D.C., with his wife, Lydia, and daughter, Lola, who is a freshman at Tulane University. He has worked in software sales and sales leadership since getting his MBA from George Washington University. He enjoys rooting for the Washington Nationals, cooking, [...]

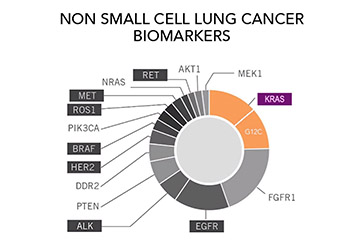

Do I Need Another Test? The Importance of Repeat Biomarker Testing in NSCLC

Author: Brittney Nichols, MPH, BSN-RN, Senior Specialist, Science & Research, GO2 for Lung Cancer Biomarker testing is an important part of the cancer diagnosis and care continuum. For almost all people diagnosed with non-small cell lung cancer (NSCLC) biomarker testing is considered a routine part of guideline-concordant care (the [...]

Unleashing Precision: AI’s Promising Role in Revolutionizing Lung Cancer Care

Author: Matthew Reiss, MSE, PhD, Manager, Precision Medicine & Navigation, GO2 for Lung Cancer You’ve likely started to see artificial intelligence (AI) being used more and more in your everyday life. While the benefits and challenges of using AI in fields such as healthcare must be carefully considered, we [...]

Antibody-Drug Conjugates (ADCs): A Promising Treatment for Lung Cancer

Author: Renee Botello, MSc, Navigator, Treatment and Trials, GO2 for Lung Cancer With decades of research and advances in precision medicine, scientists continue to broaden the treatment standards and options for patients with non-small cell lung cancer (NSCLC). By developing new ways, strategies, and innovative research techniques, this rapid [...]

Nicole Phipps Is Spearheading GO2’s Efforts to Confront Lung Cancer Every Day for Everyone

Nicole Phipps took a job working in lung cancer advocacy almost thirteen years ago to honor her grandfather, a lung cancer survivor. Now she’s applying that passion—and her considerable skills—to ensure that vital lung cancer education, support, connection, and community are accessible to all. Meet [...]

Fern Halper, PhD: Data, AI, and Its Promise for People With Lung Cancer

Fern Halper, PhD, vice president and senior director of TDWI Research and GO2 board member Fern Halper, PhD has a lifelong passion for data. She has spent more than a decade collecting, managing, and analyzing large amounts of data for a Fortune 500 company and another two [...]

FDA Approves Tepmetko (tepotinib) for People with Metastatic Non-Small Cell Lung Cancer with MET-Exon 14 Mutation

On Feb. 15, 2024, the U.S. Food and Drug Administration (FDA) granted traditional approval of Tepmetko (tepotinib) for people living with metastatic non-small cell lung cancer (NSCLC) with a MET-Exon 14 mutation. Tepmetko (tepotinib) initially received accelerated approval in 2021 based on initial results from the VISION study, which [...]

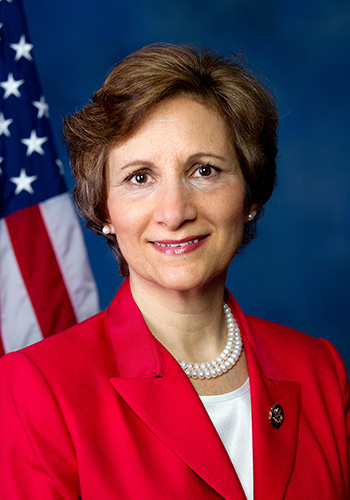

Lung Cancer is the Leading Cause of Cancer Death in Women—GO2 for Lung Cancer President & CEO Provides Testimony as Part of the “Legislative Proposals to Support Patients and Caregivers” Hearing

WASHINGTON, Feb. 16, 2023—GO2 for Lung Cancer President and CEO Laurie Ambrose submitted testimony to the House Committee on Energy and Commerce, Subcommittee on Health. Ambrose’s testimony was in support of the Women and Lung Cancer Research & Preventive Services Act of 2023, introduced in the House by Congressman [...]

GO2 for Lung Cancer Appoints Courtney Granville, Ph.D., M.S.P.H. as Chief Scientific Officer

Granville brings experience overseeing scientific strategy and research WASHINGTON, Feb. 12, 2024 — GO2 for Lung Cancer (GO2) announced that it has hired Courtney Granville as chief scientific officer. In this role, she oversees GO2’s community-engaged research, clinical research, Lung Cancer Registry, and LungMATCH programs. She develops and manages the implementation [...]

Faith, Family, and a Groundbreaking Trial

Aundrea H. is a married mother of three who lives in Washington state, where she homeschools her children (ages 17, 15, and 12). She enjoys spending time with her family and friends as well as being involved in church activities. My diagnosis In December 2023, I was recovering [...]

Living Room Show Notes: What To Do if Resistance Develops

Many people being treated for lung cancer will eventually develop resistance to their current therapies, causing them to stop working. When this happens, and a person’s cancer starts to progress on their current treatment, their healthcare team will take a tissue and/or liquid biopsy to access their new treatment [...]

Ask the Experts: Do I Need a Bronchoscopy?

Question: My doctors discovered something abnormal on a scan of my lungs that they suspect may be lung cancer. I’ve been told that I need a bronchoscopy to biopsy the growth to confirm this diagnosis and determine the stage of my cancer. Do I still need to do this [...]

GO2 Joins National Leaders Calling on the White House to Expand Women’s Health Research and Funding

GO2 for Lung Cancer joined a diverse group of women’s health champions by signing two letters sent to First Lady Jill Biden, who leads the White House Initiative on Women’s Health Research. The letters offer insights and recommendations on opportunities to fundamentally change approaches to increased health research and [...]

Ask the Experts: Support Groups

Question: There is not a lung cancer support group near me, and I would like to start one. What do I do? Answer: You have come to the right place! For decades, GO2 has monitored lung cancer-specific support groups across the country, so we know where to refer people [...]

A New Perspective: Ellen’s Story

Ellen S. is a three-year survivor of stage 4 (IV) non-small cell lung cancer. She retired two years ago after a 22-year career as an occupational therapist in New York. She loves to travel and hike and has visited Ecuador, Costa Rica, Cambodia, Morocco, Iceland, and many states in [...]

Top Five Living Room Episodes of 2023

In 2023, you—the lung cancer community—watched our Lung Cancer Living Room episodes more than 43,000 times! We know that every episode resonates with different people who are living with or at risk for lung cancer depending on their current experiences or interests, but five rose to the top as [...]

Meet the Honorees: 18th Annual Simply the Best Gala

For the past 18 years, we have held our Simply the Best Gala with survivors, loved ones, providers, researchers, and industry partners, to celebrate and honor outstanding members of the lung cancer community. “We are grateful to the many dedicated individuals that bring tangible hope to people at risk [...]

Adedayo Adeniyi: Making an Impact One Policy at a Time

Adedayo Adeniyi was drawn to public health advocacy because he knows how one piece of legislation can change the lives of many. Adedayo, who has a degree in public health and a master’s in public policy, is GO2 for Lung Cancer’s government affairs manager, where he is responsible for [...]

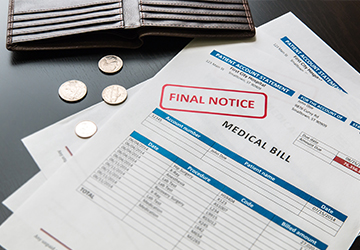

Ask the Experts: Insurance Coverage for Lung Cancer Treatment

Question: My insurance does not cover the cost of my lung cancer treatment. What are my options? Answer: When insurance does not cover the cost of lung cancer drug treatments, there are a few options to explore for financial assistance. Get to know your insurance: We know dealing with [...]

Living Room Show Notes: Our Year of HOPE

For our last Lung Cancer Living Room of 2023, host and GO2 for Lung Cancer Chief Patient Officer, Danielle Hicks, led a conversation looking back at GO2’s growth and impact over the past 12 months. Titled “Our Year of HOPE,” this episode detailed some of the important programs and [...]

2023 Year in Review

Author: Laurie Fenton Ambrose, GO2 for Lung Cancer CEO, President, and Co-Founder It seems like only yesterday that we raised a toast to 2023, and yet another year is rapidly winding down as we find ourselves preparing for a wonderful holiday season, surrounded by family and friends celebrating special [...]

The Power of Advocacy

Sven de Jong wants elected officials to see the faces of lung cancer. Sven de Jong knows that personalizing lung cancer matters. After his wife Elizabeth was diagnosed with stage 4 (IV) ALK+ non-small cell lung cancer in September 2016, the couple was determined [...]

Find Hope, Help, and a Home

Amita Jain supports GO2 for Lung Cancer to help others, too. Shortly after Amita Jain was diagnosed with stage 4 (IV) lung cancer in January 2019, her then-teenage daughter went looking for information and found GO2 for Lung Cancer. She and her father started attending the monthly Lung Cancer [...]

Ask the Experts: Nutrition During Treatment

Answered by Michele Szafranksi, MS, RD, CSO, LDN, Clinical Nutrition Manager, Section of Oncology Nutrition, Department of Supportive Oncology, Levine Cancer Institute Question: I was diagnosed with lung cancer a few weeks ago and am about to start treatment. What role can nutrition play in helping me to feel [...]

Advancing the Frontiers of the Field: Bonnie Addario

Since her own diagnosis 18 years ago, our co-founder, Bonnie J. Addario, has made it her mission to ensure that every person living with lung cancer has a voice representing their needs. Bonnie began her activism by founding the Addario Lung Cancer Foundation, now GO2 for Lung Cancer, to [...]

Living Room Show Notes: Lung Cancer Awareness Month (LCAM) Edition

During November for Lung Cancer Awareness Month (LCAM), GO2 for Lung Cancer and the LCAM Coalition hosted a special Lung Cancer Living Room to discuss stigma. The LCAM Coalition raises awareness about lung cancer and the need for more research, screening, and treatment options to improve survival. Lung [...]

Treatments and Study Updates: Highlights from ESMO 2023

Contributing Authors: GO2 for Lung Cancer Associate Director, Clinical Research, Andrew Ciupek, PhD and Manager, Precision Medicine & Navigation, Matthew Reiss, MSE, PhD Each year, researchers, physicians, and industry partners gather at the European Society for Medical Oncology (ESMO) Congress to share the latest updates on new treatments [...]

Sydney Barned Wants You to Join Her at the Lung Cancer Voices Summit

Sydney Barned, MD, has marked the date on her calendar: March 3–5, 2024. That’s when lung cancer advocates nationwide will unite in D.C. for GO2’s next Lung Cancer Voices Summit. She’s passionate about advocacy and wants more people, especially younger women, to join her in [...]

Ask the Experts: All About Biomarkers

Question: I was just diagnosed with lung cancer. My doctor told me that I should have biomarker testing done to determine the best treatment for me. What are biomarkers, and why will testing for them affect my treatment options? Answer: “Biomarkers” are mutations or changes inside cancer cells that [...]

Living Room Show Notes: Medical and Radiation Oncologists

Medical and radiation oncologists are important members of your lung cancer care team who work together with you to determine your treatment plan and deliver your care. Drs. Jonathan Riess and Megan Daly from UC Davis’s Comprehensive Cancer Center joined GO2’s October Lung Cancer Living Room to discuss the [...]

GO2 for Lung Cancer Celebrates the Lung Cancer Community at the 18th Annual Simply the Best Gala

SAN CARLOS, Calif. and WASHINGTON (November 13, 2023) – GO2 for Lung Cancer (GO2) honored champions of lung cancer at its 18th Annual Simply the Best Gala held in San Francisco on November 11. This special evening was an opportunity to recognize industry partners, researchers, doctors, nurses, survivors, funders, and individual supporters [...]

FDA Approves Augtyro (repotrectinib) for People with Locally Advanced or Metastatic ROS1-Positive Non-Small Cell Lung Cancer

On Nov. 16, 2023, the U.S. Food and Drug Administration (FDA) approved Augtyro (repotrectinib) for people living with locally advanced or metastatic non-small cell lung cancer (NSCLC) with a ROS1 gene mutation. The approval was based on results from the TRIDENT-1 study, which evaluated the use of Augtyro (repotrectinib) [...]

Heather Law Is Looking to Crack the Code on Lung Cancer

Seeking insights from the causes of lung cancer to support for family caregivers Heather Law, MA, is seeking answers. She wants to understand why some people get lung cancer and others don’t. She’s anxious to learn how treatments change over time and what improves a person’s quality of life. [...]

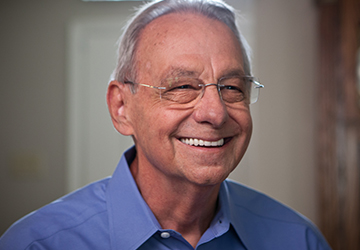

Cliff Norton Brings Hope, Determination to Lung Cancer Advocacy

When Cliff Norton walks into a room, he brings hope through the door with him. Diagnosed with stage 4 (IV) lung cancer in July 2010, he was declared NED (no evidence of disease) in December 2012. More than a decade and many PET scans later, he’s still cancer-free. His [...]

Rick Sherlock Brings a Life of Service to the Lung Cancer Community

Rick Sherlock has spent his life in service to others. The retired army major general has flown Chinooks, Blackhawks, and other aircraft. He has served his country at home and abroad, including tours of duty in South Korea, Iraq, and Germany, as well as several tours of duty at [...]

Groundbreaking Research on Inherited Gene Mutation in Lung Cancer Published in Journal of Clinical Oncology

GO2 for Lung Cancer announced that researchers have described a new familial syndrome in people with lung cancer caused by an inherited gene mutation. The research study was published this month in the Journal of Clinical Oncology. The report chronicles the methods and findings of the INHERIT study, more than [...]

GO2 for Lung Cancer Launches PSA Featuring Actor and Director Tony Goldwyn for National Lung Cancer Awareness Month in November

Goldwyn has a personal connection to lung cancer WASHINGTON, November 1, 2023— GO2 for Lung Cancer, is launching a public service announcement campaign starting the first of November in conjunction with National Lung Cancer Awareness Month. The PSA features acclaimed actor, producer and director Tony Goldwyn, recently seen in the blockbuster [...]

Ask the Experts: Surgery for Lung Cancer

Question: I’ve just been diagnosed with lung cancer, and my doctor said I may need to have surgery. What can I expect? Answer: Your healthcare team will explain the best type of surgery for you, but the goal will be to remove all of the tumor(s) without removing too [...]

Do You Speak Spanish?

Haga clic aquí para leer esta página en español. GO2 for Lung Cancer is excited to expand its Spanish-language offerings, and we need your help! If you have been diagnosed with lung cancer, or are a caregiver for someone with the disease, and are frustrated by the lack of [...]

Presidential Proclamation Designates November 2023 as National Lung Cancer Awareness Month

As we come together on the eve of Lung Cancer Awareness Month, we are excited to share that President and First Lady Biden have joined us again to bring much-needed attention to this disease by issuing a Presidential Proclamation designating November 2023 as National Lung Cancer Awareness Month. As in [...]

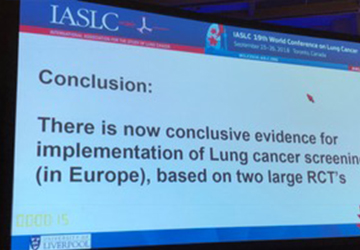

Treatments, Trials, and Technology in Lung Cancer

Author: GO2 for Lung Cancer Specialist, Science & Research, Brittney Nichols MPH, BSN-RN Each year, scientists and doctors from across the globe gather at IASLC’s World Conference on Lung Cancer (WCLC) to discuss the latest and greatest in lung cancer treatment and research. New treatment options on the horizon [...]

New Clinical Trial Designs in the Era of Precision Medicine

Author: GO2 for Lung Cancer Associate Director, Clinical Research, Andrew Ciupek, PhD With an increasing number of targeted therapies becoming available, making treatment decisions based on the results of biomarker testing has become an essential part of cancer care – especially in lung cancer. At the same time, researchers [...]

Addressing the Unmet Needs of Family Caregivers of People with Lung Cancer

Author: Lung Cancer Registry Associate Director, Heather Law, MA Family caregivers often experience emotional distress and neglect their own well-being while caring for a loved one. Preliminary findings from GO2’s Lung Cancer Registry Caregiver Survey were presented at the 2023 World Conference on Lung Cancer (WCLC) in Singapore in September. Understanding the unmet need Advances in diagnostic [...]

Perspectives from Providers, Patient Advocates, and People Living with Lung Cancer

Author: GO2 for Lung Cancer's Specialist, Science & Research, Brittney Nichols MPH, BSN-RN The IASLC annual World Conference on Lung Cancer (WCLC) unites lung cancer professionals from across the world to connect and share insights. This goes beyond the science and medicine of treating and diagnosing lung cancer—it expands [...]

Lung Cancer After Tagrisso Resistance: What Next?

Author: GO2 for Lung Cancer Treatment and Trials Navigator, Renee Botello MSc Tagrisso (osimertinib) has been the treatment of choice and effective standard of care option for the treatment of EGFR+ non-small cell lung cancer (NSCLC) since its FDA approval in 2018 as a first-line treatment for EGFR+ NSCLC. [...]

ASCO Issues New Recommendation Cosela (Trilaciclib) in Update to its Treatment Guidelines for Small Cell Lung Cancer

On October 11, 2023, the American Society of Clinical Oncology (ASCO) recommended an update to its treatment guidelines for small cell lung cancer (SCLC). Cosela (trilaciclib) has been recommended as a myeloid supportive agent for individuals with extensive-stage SCLC who are receiving treatment with chemotherapy or chemoimmunotherapy. Myelosuppression or bone [...]

FDA Approves New Treatment Regimen for Individuals Receiving Keytruda (pembrolizumab) for Resectable Non-Small Cell Lung Cancer

On October 16, 2023, the U.S. Food and Drug Administration (FDA) approved a new treatment plan for people receiving Keytruda (pembrolizumab) for resectable non-small cell lung cancer (NSCLC). This approval is based on results from the KEYNOTE-671 (NCT03425643) clinical trial that assessed a new treatment plan for persons with [...]

FDA Approves Combination Braftovi (encorafenib) and Mektovi (binimetinib) for Metastatic BRAF-Mutated Non-Small Cell Lung Cancer

On October 11, 2023, the U.S. Food and Drug Administration (FDA) approved a combination of Braftovi (encorafenib) and Mektovi (binimetinib) for people with metastatic non-small cell lung cancer (NSCLC) with a BRAF V600E mutation. BRAF is a less common genetic mutation, affecting 1-2% of individuals diagnosed with NSCLC, and [...]

Living Room Show Notes: What’s New in Pulmonary Care

“If you can’t breathe, nothing else matters.” This powerful statement was shared by Dr. D. Kyle Hogarth from the University of Chicago during September’s Lung Cancer Living Room to emphasize the importance of having a pulmonologist on your lung cancer care team. A pulmonologist is a medical professional who [...]

Ask the Experts: I’m Worried About Bothering My Doctor. What Should I Do?

Question: I have many questions about my lung cancer diagnosis and treatment options, but I’m worried about bothering my doctor. What should I do? Answer:* If you have an oncologist who makes you feel like you shouldn’t be contacting them, then you have the wrong oncologist. What will keep me [...]

A Laugh a Day

Author: Dr. Jennifer K. Renshaw, OTD, OTR/L, OTA/L There are many words for laughter: chuckling, giggling, snickering, hooting, hollering, and howling. But is laughter really the best medicine? Whether you are a person living with lung cancer or a caregiver, laughter may be a resource to consider. According to [...]

A Passion for People: How Jennifer Hughes Confronts Lung Cancer

Jennifer Hughes is getting ready for a party next month. And not just any party, but GO2 for Lung Cancer’s “Simply the Best” gala. Hughes, senior director of national events, oversees every detail of GO2’s gala, which raises awareness and resources to confront lung cancer. It’s [...]

Finding Strength After a Small Cell Lung Cancer Diagnosis: Bob’s Story

After spending over 20 years in the hospitality field, Bob Iles changed careers and joined the stock brokerage industry before retiring almost six years ago. He and his husband live in Palm Springs, CA, where he enjoys swimming in his lap pool, hiking, biking, volunteering for environmental and LGBTQ+ [...]

Ask the Experts: Neo-Adjuvant vs. Adjuvant Therapy

Question: What is the difference between neo-adjuvant therapy and adjuvant therapy? Answer: “Neo-adjuvant” and “adjuvant” are terms used in the context of cancer treatment to refer to therapies that are given before or after the primary treatment, such as surgery or radiation therapy. Neo-adjuvant therapy refers to treatment given before [...]

Support for Small Cell Lung Cancer

GO2 for Lung Cancer’s Small Cell Lung Cancer (SCLC) program offers education, support, and connection to those affected by SCLC. People living with SCLC often have different needs than those with non-small cell lung cancer (NSCLC). Our SCLC program aims to better meet those needs by expanding our SCLC-specific resources, [...]

Top Treatment Takeaways from the World Conference on Lung Cancer

Every year, lung cancer professionals from across the globe gather to connect and learn at the World Conference for Lung Cancer (WCLC). Members of the GO2 team just returned from WCLC 2023 hosted in Singapore, where they presented GO2’s work as well as learning about the latest treatment updates. [...]

A New Lease on Life: Mike’s Story

By Mike Knecht Mike Knecht retired from his career as an electrical contractor and business owner in 2019 and spent the following year traveling through the United States and Africa. In early 2023, he and his wife, Lois, sold their home in Maryland to live full-time in their vacation/retirement home in West Virginia. Mike enjoys a wide variety of activities from hobby farming on his 150-acre mountain-top property, to visiting his daughters and grandchildren on both [...]

Scanxiety: Tips from a Survivor and Expert

By Alison Mayer Sachs, MSW, LSW, OSW-C, FAOSW, Director, Community Outreach & Cancer Support, Services, Eisenhower Lucy Curci Cancer Center, Eisenhower Medical Center and lung cancer survivor “Scanxiety” is a term that people with cancer use to describe the anxiousness and fear they experience before, during, and after scans to [...]

Living Room Show Notes: New Age of Small Cell Lung Cancer

Small cell lung cancer (SCLC), which represents about 15% of all lung cancer diagnoses, is an often-aggressive form of lung cancer that has historically been difficult to treat. However, the science driving new treatments for SCLC is moving faster than ever before, with more drugs in development right now than [...]

Ask the Experts: At Stage 1A, Do I Need Chemo?

Question: A small 2 cm nodule was recently found in my lung and I had an upper lobectomy. The surgeon said the margins were clear and there was no cancer found in the lymph nodes. They said the stage is IA (1A) and scheduled me for a scan in [...]

Processing Trauma After a Lung Cancer Diagnosis

By Susan Smedley Susan Smedley is a 25-year lung cancer survivor and former social worker who worked in the national lung cancer community for 15 years, most recently at GO2 for Lung Cancer. As a yoga instructor trained in oncology and trauma-informed yoga, she retired from nonprofit work to [...]

GO2’s Joelle Fathi Wants to Transform Healthcare

Joelle Fathi is on a mission to make a meaningful contribution and transform healthcare to make it more equitable. It’s an ambitious goal that GO2 for Lung Cancer’s chief healthcare delivery officer believes is essential to increase lung cancer survivorship in the long term. We caught up with Fathi [...]

Survivor Spotlight: Presley A.

My name is Presley and I was diagnosed with stage 4 (IV) non-small cell lung cancer on Sept. 19, 2022. It felt like the rug had been pulled out from under me. I was only 34 years old, a wife, and a mother of four children all under the [...]

Donor Spotlight: Jana B.

Jana Brownell is the Chairman of the Kirlin Company and has been a GO2 for Lung Cancer supporter since 2001. My mom was diagnosed with non-small cell lung cancer (NSCLC) in 2001. At the time of my mom’s startling and unimaginable diagnosis, we were focused on my dad, who [...]

GO2 Receives a $250,000 Award

GO2 for Lung Cancer to Receive a $250,000 Engagement Award to Build Capacity for Patient Engagement in Research Within a Stigmatized Lung Cancer Community San Carlos, CA and Washington, DC – Today GO2 for Lung Cancer (GO2) announced its Chief Healthcare Delivery Officer, Dr. Joelle Fathi, DNP RN, ARNP, CTTS, [...]

Stronger Together: GO2 for Lung Cancer and KRAS Kickers

GO2’s Phone Buddy Program, first launched in the 1990s, is a peer-to-peer matching program that pairs people who have been diagnosed with lung cancer to share stories, hope, and wisdom with one another. As a GO2 Phone Buddy herself, Terri Conneran, founder of KRAS Kickers, knows the value of bringing [...]

Ask the Experts: Clinical Trials for KRAS+ Lung Cancer

Question: I have KRAS+ lung cancer. Are there any clinical trials available for me? Answer: Yes! No matter what kind of lung cancer you are diagnosed with, there is likely a trial appropriate for you. GO2 for Lung Cancer has our own KRAS study — launched with our medical research consortium, [...]

Meet GO2’s New National Ambassador Council Members

Bob Nicklas, nine (9) year lung cancer survivor and GO2 NAC member Two new advocates joined GO2 for Lung Cancer’s National Ambassador Council (NAC) and participated in their first meeting last month. Bob Nicklas joins NAC after receiving GO2’s 2022 Voices Summit Leadership & Advocacy Award, serving [...]

Living Room Show Notes: Best of ASCO 2023

The American Society of Clinical Oncology (ASCO) hosts an annual meeting every spring where oncologists and other physicians, researchers, industry members, and advocacy organizations like GO2 come together to share and learn the latest and most exciting news on emerging science in the cancer field. While ASCO covers all [...]

Screening Saves Lives: Barney’s Story

By Barney Brinkmann Barney Brinkmann retired four years ago after a 40-year career with AT&T as an engineer in St. Louis and Dallas. His sense of wanderlust has taken the St. Louis native to India (five times!); scuba diving off Tioman Island, the Hawaiian Islands, and the South Pacific; [...]

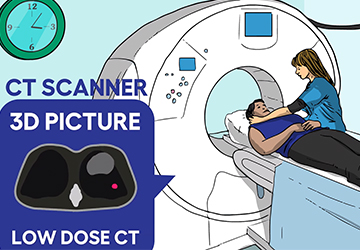

Ask the Experts: Lung Cancer Screening

Question: My children want me to talk to my doctor about being screened for lung cancer. How do I know if I’m eligible and what should I expect? Answer: Annual lung cancer screening is recommended for people whose age and smoking history put them at higher risk for lung [...]

GO2 for Lung Cancer Honors David Carbone, MD, PhD with the 2023 Bonnie J. Addario Lectureship Award

SAN CARLOS, Calif. and WASHINGTON, D.C. (July 28, 2023) – GO2 for Lung Cancer (GO2) announced today that it presented David Carbone, MD, PhD with the 2023 Bonnie J. Addario Lectureship Award for his work developing treatments for lung cancer. GO2 honored Dr. Carbone with the award at the 24th International Lung Cancer Conference [...]

ASCO 2023: Surviving and Thriving with Lung Cancer

By Brittney Nichols, MPH, RN-BSN, Science and Research Specialist, GO2 for Lung Cancer New treatments, developments, and scientific breakthroughs are always one of the most exciting aspects of the annual American Society of Clinical Oncology (ASCO) conference, but this year they weren't the only highlight. People with lung cancer, [...]

ASCO 2023: Progress for Metastatic (Stage 4) Non-Small Cell Lung Cancer

By Andrew Ciupek, PhD, Associate Director, Clinical Research, GO2 for Lung Cancer New research on metastatic (stage 4) non-small cell lung cancer (NSCLC) was a hot topic at the 2023 American Society of Clinical Oncology (ASCO) meeting. Data from several studies was shared, including new developments for both people [...]

ASCO 2023: Advances in Early-Stage Lung Cancer Research

By Jennifer C. King, PhD, Chief Scientific Officer, GO2 for Lung Cancer While the past decade has seen the development of many new therapies for lung cancer, these drugs are typically first approved for metastatic cancer (cancer that has spread) and not used for earlier stages. We are now [...]

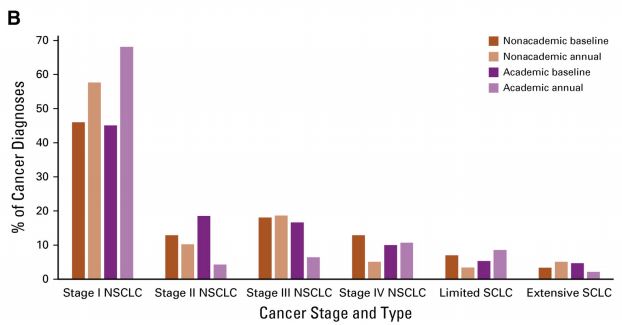

ASCO 2023: New Advances in Lung Cancer Screening

By Heather Law, MA, Associate Director, GO2’s Lung Cancer Registry Lung cancer screening is unavailable for many people at risk for lung cancer. At the 2023 American Society of Clinical Oncology (ASCO) meeting, early results from groundbreaking studies offered hope for expanded screening in the United States. Current [...]

Hope and Time: Tamara’s Story

By Tamara Gabrielli, MD Dr. Gabrielli recently retired after a 30-year career as an anesthesiologist in Maryland and Washington, D.C. She lives in Rockville, MD and has three daughters in their 20s. She just celebrated her 64th birthday. My diagnosis I was diagnosed with lung cancer about 16 [...]

Ask the Experts: Neuroendocrine Tumors

Question: I was diagnosed with small cell lung cancer and my oncologist called it a neuroendocrine tumor. What does that mean? Answer: Neuroendocrine cells are like nerve cells, but they also release hormones into the body like cells of the endocrine system. A neuroendocrine tumor (NET) is a type [...]

Living Room Show Notes: Special Edition – Early Detection, Treatment, and Access to Care

In a Special Edition Lung Cancer Living Room that aired on June 6, 2023, Dr. Steven Liu from Georgetown University shared an introduction to lung cancer, plus an overview of its history including staging diagnosis. In clear, easy-to-understand language, he detailed the most up-to-date information about treatment options, including [...]

My Experience with Brain Radiation

By Shelly Engfer-Triebenbach I was just finishing up my 18th year of teaching music when I noticed myself getting short of breath doing easy things. I went to see my primary care doctor who gave me antibiotics and an inhaler so I could treat what they thought was [...]

Ask the Experts: Questions to Ask Your Doctor

Question: My mom was just diagnosed with lung cancer. What questions should we be prepared to ask at her next doctor’s appointment? Answer: Receiving a lung cancer diagnosis and learning about treatment options can be scary and stressful for a person with lung cancer and their loved ones. [...]

Living Room Show Notes: Clinical Trials and Innovative Trial Design

Clinical trials are a critical part of developing future treatments for lung cancer and other diseases, but low enrollment indicates that they are also often misunderstood by people who might benefit from them. In June’s Lung Cancer Living Room, GO2 for Lung Cancer’s Chief Patient Officer, Danielle Hicks, was [...]

Legislation Introduced to Accelerate Life-Saving Change for Women Impacted by Lung Cancer

The Women and Lung Cancer Research and Preventive Service Act Will Expand Resources to Understand the Science of Lung Cancer in Women San Carlos, CA and Washington, DC – Today, GO2 for Lung Cancer (GO2) applauded the efforts of a bipartisan and bicameral group of lawmakers to address the [...]

Finding Your Calm

Author: Dr. Jennifer K. Renshaw, OTD, OTR/L, OTA/L Have you ever experienced a racing heart, sweaty palms, sleeplessness, worry, headaches, nervousness, decreased focus, or even full body anxiety? As you learn to live with lung cancer and manage all that it can bring, fear of the unknown can overwhelm [...]

Meet Triage Cancer

GO2 for Lung Cancer is proud to partner with Triage Cancer, a national nonprofit organization that provides free education on the legal and practical issues that impact many people who are diagnosed with cancer and their caregivers. Triage Cancer was founded in 2012 by two cancer rights attorneys who [...]

Ask the Experts: Palliative Care Versus Hospice Care

Question: My doctor recently suggested that I start palliative care to help with some of the side effects I’m experiencing from my lung cancer treatment. Is this the same thing as hospice care? Answer: No. Palliative care and hospice care share some similarities, but they are not the same [...]

Living Room Show Notes: Palliative Care, Treating the Whole Person

Palliative care is an important part of many people’s lung cancer care plan. The purpose of palliative care is to improve quality of life. It may provide relief from pain and other symptoms and side effects of lung cancer and is appropriate for patients at every stage of their [...]

A Young Father’s Story

Stephen Huff was just 29 years old and finishing up his first year as a teacher when he started experiencing some changes to his health. His career playing college and professional baseball had recently ended and he thought the weight gain and shortness of breath he was experiencing were [...]

Ask the Experts: The Importance of Multidisciplinary Care Teams

Question: I keep hearing about the importance of having a multidisciplinary care team for my lung cancer treatments. What does “multidisciplinary care team” mean and who might be on it? Answer: A “multidisciplinary care team” is a group of doctors, nurses, and other healthcare professionals from different fields who [...]

Remembering Lung Cancer Champion Win Boerckel

By GO2 Senior Director, Support Initiatives, Maureen Rigney, LICSW Win Boerckel receiving GO2’s inaugural Lung Cancer Support Group Facilitator Award in 2009 Treasured GO2 friend and staunch lung cancer advocate, Winfield Boerckel, died in May following a diagnosis of brain cancer. Some of you may have had [...]

Our 2023 Volunteer Leadership & Advocacy Award Winner: Heidi Nafman-Onda

We are excited to announce that our 2023 Volunteer Leadership & Advocacy Award winner is Heidi Nafman-Onda! This award honors a member of the lung cancer community for their outstanding leadership in volunteerism and advocacy and is awarded annually at GO2’s Lung Cancer Voices Summit. Heidi was a fitness trainer [...]

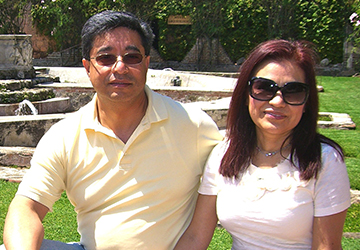

Ask the Experts: Traveling with Lung Cancer

By lung cancer advocate and experienced world traveler, Elizabeth de Jong Question: I will be traveling this summer for the first time since being diagnosed with lung cancer last year. What should I consider to make travel safe, easy and fun, given my new diagnosis? Elizabeth and Sven [...]

Living Room Show Notes: The Next Wave of Precision Medicine

Treatment for lung cancer has advanced considerably over the years and has been accelerating at an even faster rate this past decade. People diagnosed with lung cancer today have newer, more personalized treatment options that may include targeted therapies, immunotherapies, combination therapies and more traditional chemotherapies or radiation. The [...]

Ask the Experts: What Does NED Mean?

Question: "I have heard people being treated for lung cancer talk about being 'NED.' What exactly does this mean? Is it the same thing as being cured?" Answer: NED stands for “no evidence of disease” and is a term that is like “remission.” NED means that there is no [...]

One Mother’s Story

Lung cancer is the leading cause of cancer-related deaths in women in the United States, taking 171 women’s lives every day. That’s more than breast, ovarian and cervical cancer combined. It affects women of all ages – our grandmothers, aunts, daughters, friends and mothers – so this Mother’s Day [...]

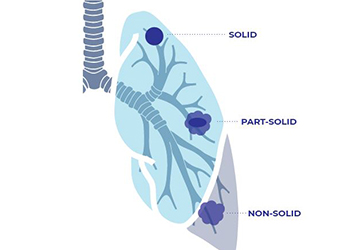

Ask the Experts: Ground Glass Nodules

Question: “I was screened for lung cancer and my scan revealed ground glass nodules in my lungs. What are these and should I be concerned?” Answer: Nodules are abnormal yet common spots that may show up on your lung cancer screening scan or other imaging tests. Some nodules may [...]

Our 2023 Lung Cancer Support Group Facilitator Awardees

GO2's Senior Manager of Support Services, Miranda Goff; award recipients Michelle Hills and Sarah Bechard; GO2's Senior Director of Support Initiatives, Maureen Rigney We are excited to announce our 2023 Lung Cancer Support Group Facilitator awardees are Sarah Bechard and Michelle Hills. Awarded annually since 2009, [...]

The Weight of Shame

Author: Terri Ann DiJulio, lung cancer survivor, CDMRP reviewer, GO2 Summit Planning Committee & NAC Member I am a lung cancer survivor … I am also an outspoken advocate in the lung cancer community. Because of this, many of you may already know that I have been diagnosed with [...]

2023 Lung Cancer Voices Summit Recap

GO2 for Lung Cancer’s Voices Summit is the only annual meeting that brings the lung cancer community together for education, training, connection and advocacy action with our federal government, the largest funder of cancer research. Nearly one hundred advocates from over half of the country gathered in Washington, DC [...]

GO2 for Lung Cancer Announces Two New Board Members

San Carlos, CA and Washington, DC – GO2 for Lung Cancer (GO2), the go-to for one-on-one assistance, supportive connections and treatment information, is pleased to announce that Marsha B. Henderson and Carol Rattray have joined their Board of Directors. “Marsha and Carol are both accomplished women in their fields [...]

Living Room Show Notes: The Vital Patient Role in Advancing Research

An important development in lung cancer research over the past decade or so is the increased prioritization of the patient experience in the research process. Including patient voices in lung cancer research helps to ensure that new research projects best meet the needs of lung cancer patients and survivors. [...]

Ask the Experts: Is Immunotherapy Right for Me?

Question: "I’ve seen commercials for immunotherapy as a treatment for lung cancer. How does it work? How do I know if it’s a good treatment for me?" Answer: Immunotherapy is a type of cancer treatment that helps the body’s own immune system find and attack cancer cells. Your [...]

A Message From Bonnie

Dear Friends, I am reaching out to all of you, my colleagues, my family and my friends to announce that the time has come for me to move on to the next chapter in my life. Planning for and thinking about this next phase has been circling in my [...]

Rays of Hope 2023 Winner: Larry Gershon

We are excited to announce our 2023 Rays of Hope Award winner, Larry Gershon! This award honors the late Richard Heimler. Richard was a GO2 for Lung Cancer board member and a powerful voice of hope in the lung cancer community. Awarded annually, the Rays [...]

U.S. House of Representatives Introduces Bill to Expand Number of Cancers Detected by Screening

The Nancy Gardner Sewell Medicare Multi Cancer Early Detection Screening Coverage Act creates a path forward for Medicare coverage of multi-cancer early detection tests WASHINGTON, D.C. – GO2 for Lung Cancer (GO2) applauds Representatives Jodey Arrington, (R-TX), Terri Sewell (D-AL), Richard Hudson (R-NC), and Raul Ruiz (D-CA) for introducing a [...]

Ask the Experts: Should I Have a Pulmonologist on My Care Team?

Ask the Experts: Should I have a pulmonologist on my lung cancer care team? Yes! The best lung cancer care requires a team of doctors who all specialize in different treatments. This type of team helps you get the best personalized care for your specific type of lung cancer. [...]

We’re Back In-Person!

GO2 for Lung Cancer is excited to announce that after airing our Lung Cancer Living Room monthly events only online for the past three years, we will be returning to in-person Living Room events from our San Carlos office beginning with April’s Living Room on Tuesday, April 18th. We [...]

Meet GO2’s National Ambassador Council

GO2 for Lung Cancer was founded by and for lung cancer patients and survivors. We incorporate the needs and experiences of the lung cancer community into every program we offer and every decision we make. Helping us understand the varied and evolving needs of this community is our National Ambassador [...]

Survivor Spotlight: Tim S.

Tim is a small cell lung cancer (SCLC) survivor, but that’s just one small part of his story. Seven years ago, Tim went to his regular check-up with his primary care doctor and mentioned that he had a cough that wouldn’t go away. He had an x-ray, and a [...]

Living Room Recap: Combatting Lung Cancer Stigma

Unfortunately, "stigma" is something many people diagnosed with lung cancer experience. Lung cancer stigma is usually tied to smoking and may present in many ways. Oftentimes someone newly diagnosed with lung cancer will immediately be asked questions about their smoking history in a very judgmental way, made to feel [...]

Ask the Experts: Talking to Your Doctor About Clinical Trials

Ask the Experts: When should I talk to my doctor about clinical trials? You and your doctor might want to consider joining a clinical trial any time you must decide about your treatment such as at initial diagnosis, upon progression or when a change in treatment is needed for [...]

Celebrating International Women’s Day

Each year, International Women’s Day celebrates the accomplishments of women worldwide while recognizing that change is still needed to make the world an equitable place for all genders. GO2 for Lung Cancer is a women-founded and women-led organization, and one of its important initiatives is to help discover why [...]

Ask the Experts: Prophylactic Cranial Irradiation (PCI)

Ask the Experts: "I have small cell lung cancer and my doctor mentioned the option of having prophylactic cranial irradiation (PCI) to help prevent the cancer from spreading to my brain. I know some people decide to have PCI and others do not. What information do I need to [...]

We Walk This Path Together: Jan Maharam and Irene Stempler‘s Phone Buddy Friendship

GO2 for Lung Cancer's Phone Buddy program began in the early 1990s. Thanks to the many volunteers who give their time to speak with others about their own lung cancer experience, it is still going strong today. The program connects people diagnosed with lung cancer and their loved ones [...]

Clearing the Brain Fog: Eight Ways to Improve Memory and Thinking

Author: Dr. Jennifer K. Renshaw, OTD, OTR/L, OTA/L Certain types of lung cancer treatment may affect your thinking skills and some people notice changes in memory and thought processes during cancer treatment. This doesn’t have to mean a loss of independence. Throughout life we often adjust our way of [...]

Ask the Experts: Second Opinions

Question: I just received a lung cancer diagnosis. I am happy with my oncologist’s plan for treatment, but my son isn’t sure that it’s the right course of action. Is there any harm in getting a second opinion? Answer: When making decisions about lung cancer treatment, getting a second [...]

Living Room Recap: Meet the GO2 Team

GO2 for Lung Cancer relentlessly confronts lung cancer on every front, every day. We were founded by patients and survivors and are dedicated to increasing survival for those at risk, diagnosed and living with lung cancer. Our work focuses on four key goals that we believe will have the [...]

Advocating for Equitable Access to Comprehensive Biomarker Testing

GO2 for Lung Cancer, in partnership with the American Cancer Society Cancer Action Network (ACS CAN) and other health advocacy groups, is supporting a campaign to reduce health disparities by working to ensure equitable access to comprehensive biomarker testing. This campaign aims to improve coverage for and access to [...]

New Study to Understand Why Cancers Progress After Using KRAS Inhibitors

Author: Jennifer C. King, PhD, Chief Scientific Officer GO2 for Lung Cancer has launched the SPARK Study to help understand cancer driven by changes in the KRAS gene. This study is through our medical research consortium, ALCMI (Addario Lung Cancer Medical Institute), in collaboration with Dr. Mark Award and [...]

A Year of Growth for GO2 Research

Authors: Andrew Ciupek, PhD, Associate Director of Clinical Research; Heather Law, MA, Associate Director of Lung Cancer Registry; Shanada Monestime, PharmD, BCOP, Director of Community Engaged Research; Daniel A. Saez, MSc, Manager of LungMATCH Navigation Program 2022 was an exciting year for GO2 for Lung Cancer. We had the privilege [...]

FDA Approvals: New Treatment Landscape in 2023

Authors: Renee Botello, MSc, Treatment and Trial Navigator; Daniel A. Saez, MSc, Manager of LungMATCH Navigation Program In 2022, the treatment landscape for lung cancer continued to evolve to provide breakthrough treatment options for people living with lung cancer. This included targeting mutations that were previously unavailable for patients as [...]

Ask the Experts: Surgery vs. Radiation

Question: I recently received a stage IA lung cancer diagnosis. Is surgery or radiation the best treatment for me? For very early-stage lung cancer, the two most common types of treatment are surgery to remove the cancer and targeted radiation to zap the small spot(s) of cancer. Sometimes when [...]

Lung Cancer Advocates Are Heading Back to Capitol Hill

After three years of virtual advocacy, the 2023 Lung Cancer Voices Summit will be held in Washington, DC, March 19-21. Lung cancer advocates will meet in person with their elected officials to advocate for critical federal research funding on lung cancer. The Lung Cancer Voices Summit is the [...]

Lung Cancer Support Groups: The Pandemic Pivot

Support Groups are a great way to connect with others who understand what you are going through. Studies show that people with lung cancer prefer lung cancer specific groups over those that include people with many types of cancer. GO2 for Lung Cancer created the National Lung Cancer Support [...]

What’s Happening in Research at GO2?

Lung cancer mortality has been declining steadily in the past two decades and the good news is the pace of the improvements have picked up! Last week, the American Cancer Society released their 2022 stats and share that the reduction in mortality has accelerated from 2 to 3% a [...]

Survivor Spotlight: Lori W.

I was diagnosed in June 2021 with stage 4 NSCLC. I did not have any real symptoms until a few days before I went to the emergency room in distress. It took more than a month for my cancer to be typed and staged. I had Non-Small Cell Lung Cancer [...]

FDA Approves Keytruda after Surgery and Chemotherapy for Early Stage Lung Cancers

On January 26, 2023, the U.S. Food and Drug Administration (FDA) approved Keytruda (pembrolizumab) for adjuvant (additional) treatment following surgery and chemotherapy for stage IB, II, or IIIA non-small cell lung cancer (NSCLC). This approval was based on the KEYNOTE-091 clinical trial where people who took Keytruda after surgery [...]

Ask the Experts: Resources for Financial Support

Question: Living with lung cancer is expensive. What resources are available to help pay for day-to-day needs? Answer: Paying for treatment is a concern for most people who are diagnosed with lung cancer. Luckily, there are programs and resources available that can help lessen the financial burden of living [...]

Gone but Not Forgotten: How Kimberly Goodloe Honors Her Sister by Raising Awareness

Kimberly Goodloe didn’t decide to become an advocate - she was called to it after heartache and tragedy struck her life in 2009, and then again in 2022. In 2009, Kimberly received urgent open-heart surgery for an abnormal heart valve. She was born with the defect but was unaware [...]

Living Room Recap: Health Equity – Community Perspectives and Experiences

Inequities in the American healthcare system cause some people with lung cancer to receive worse care than others. Patients who are members of racial, ethnic or sexual minority groups; live in rural areas and have lower income and/or insurance levels are less likely to be screened for lung cancer, [...]

Gathering HOPE is Growing! And You’re Invited!

Have you joined us at a Gathering HOPE event? We first introduced this monthly social/support gathering in Fall 2021 and it has become one of our most popular programs. Dozens of lung cancer community members join us on the 2nd Tuesday of the month at 5-6:30pm PT/8-9:30pm ET for [...]

Ask the Experts: Changing Lung Cancer Diagnosis

Question: My tumor’s original biopsy showed that I had non-small cell lung cancer with an EGFR biomarker. Recently, the cancer started progressing and my most recent biopsy shows that I have transformed small cell lung cancer. What does this mean and how is it treated? When a certain lung [...]

Energy Conservation: Turning ON Your Energy

Author: Dr. Jennifer K. Renshaw, OTD, OTR/L, OTA/L Cancer treatment can make you tired which can make it harder to enjoy leisure activities and complete daily tasks. “Energy conservation” includes tips and tricks for you that use energy in different ways so that you feel better and can do [...]

What a Year! A Message From Our Co-Founders

Dear Friends, As we reflect on this past year, we have much to be grateful for. With the worst of the COVID-19 pandemic behind us, GO2 reaffirmed our commitment to confronting lung cancer on every front, every day to transform survivorship. We reached thousands more patients, survivors, caregivers, and [...]

FDA Approves Krazati for Lung Cancer with a KRAS G12C Mutation

On December 12th, 2022, the Food and Drug Administration (FDA) approved Krazati (adagrasib) for treatment of non-small cell lung cancer (nsclc) where there is a KRAS G12C mutation. This approval is for patients who have received at least one line of prior treatment such as chemotherapy. The FDA based their [...]

Living Room Recap: What is Health Equity and Why Does it Matter?

Heath equity is a popular topic these days, but the concept is more than just a trendy phrase. In general, the health care system in the United States distributes services inefficiently and unevenly across populations which causes some Americans to receive worse care than others. These are called “inequities.” [...]

Ask the Experts: Lung Cancer and Family History

Question: I have a family history of lung cancer – both my mother and grandmother were diagnosed with the disease. Am I at greater risk for lung cancer because of genetics? The role that genetics plays in determining someone’s lung cancer risk is not fully understood. While most [...]

Trends in Lung Cancer Treatments

A popular way to talk about the incredible progress that has been made in lung cancer treatments over the past few years is to share the statistic that more lung cancer treatments have been approved in the past three or five years or than in the previous twenty or [...]

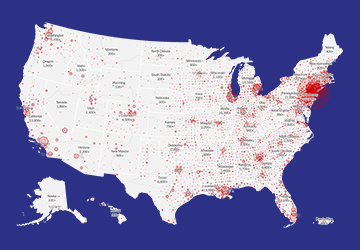

Hundreds of Health Facilities Hosted “Shine A Light on Lung Cancer” Events in November for Lung Cancer Awareness Month

Events brought together patients, health providers and caregivers for hope and healing. SAN CARLOS, CA and WASHINGTON, Nov. 30, 2022 – During November hundreds of health facilities hosted Shine A Light on Lung Cancer events – which made it the largest coordinated lung cancer awareness program in the country. It was the [...]

New Study to Address Cancer Treatment Resistance for People Who Are KRAS Positive

SAN CARLOS, Calif., (November 30, 2022) – The Addario Lung Cancer Medical Institute (ALCMI), a patient-founded not-for-profit global research consortium, has launched the SPARK Study to help researchers better understand treatment resistance in patients with KRAS-positive lung cancer and other cancer types. ALCMI is partnering on the study with [...]

Ask the Experts: Biomarkers and Biopsies

Question: My doctors have determined that my lung cancer is progressing on its current targeted therapy and want to do another biopsy. Why would I need another biopsy since we already know the biomarker type? If I do need another biopsy, should I consider a tissue biopsy or a [...]

What to Expect When you Call GO2’s HelpLine

It can be hard to know where to go with your questions about lung cancer risk, diagnosis and treatment or how to connect with others who have had similar experiences. GO2’s HelpLine staff is here to help! You can contact the HelpLine by phone at 1-800-298-2436 or email us [...]

Survivor Spotlight: Heidi Hanson on Finding Your Strength and Living in the Moment

When Heidi Hanson was diagnosed with stage 4 metastatic small cell lung cancer (SCLC) in December 2021, it wasn’t the typical story. Heidi had been suffering from headaches and dizziness which sent her to the emergency room. It was there that she was told surgery was needed to remove [...]

GO2 for Lung Cancer Honors Champions of the Lung Cancer Community at Simply the Best XVII Gala

FOR IMMEDIATE RELEASE November 14, 2022 Contact: Julia Spiess Lewis julia@perrycom.com 916-601-8282 GO2 for Lung Cancer Honors Champions of the Lung Cancer Community at Simply the Best XVII Gala SAN CARLOS, Calif. and WASHINGTON (November 14, [...]

FDA Approves Imjudo and Imfinzi in Combination with Chemotherapy for Patients with NSCLC

On November 10th, 2022, the Food and Drug Administration (FDA) approved Imjudo (tremelimumab) in combination with Imfinzi (durvalumab) and platinum-based chemotherapy for treatment of non-small cell lung cancer where there are no changes in ALK or EGFR. The FDA based their approval on the results of the clinical trial [...]

Matt Peterson Spotlight Story – Part 2

In 2019, Matt Peterson, a Vietnam veteran, was diagnosed with extensive-stage small cell lung cancer. He was told by his doctor, “This is a life-limiting diagnosis. You will not survive this.” Many people with small cell hear similar words or read information online that feels dire or hopeless, and [...]

Living Room Show Notes – Understanding Lung Nodules

Author: Danielle Hicks, Chief Patient Officer Discovering that you have a lung nodule can be understandably scary. While they are common and can lead to lung cancer, most are not cancerous. According to October’s Living Room speaker Dr. Anthony Lanfranco from the University of Pennsylvania, even those that do [...]

Ask the Experts: LCAM Edition

Question: I was just diagnosed with lung cancer this year, so this is my first Lung Cancer Awareness Month. I want to participate, but I’m not sure how. What are the best ways to support Lung Cancer Awareness Month this year? Participating in Lung Cancer Awareness Month activities is [...]

FDA Approves Libtayo in Combination with Chemotherapy for Patients with NSCLC Regardless of PD-L1 Status

On November 8th, 2022, the Food and Drug Administration (FDA) approved Libtayo (cemiplimab-rwlc) for treatment of non-small cell lung cancer where there are no changes in ALK, EGFR or ROS1 in combination with platinum doublet chemotherapy. The FDA based their approval on the results of the clinical trial Study [...]

The WHAM Report: Investing Just $40 Million New Dollars in Lung Cancer Research Related to Women Has Dramatic Impact on U.S. Economy

Lung cancer kills more women in the U.S. than breast, ovarian and cervical cancers combined. The report commissioned by Women’s Health Access Matters (WHAM) is based on novel microsimulation modeling from the RAND Corporation and documentation consistent with previous analyses on women and Alzheimer’s, coronary artery disease and rheumatoid [...]

GO2 for Lung Cancer Honors Key Partner in Fight Against Lung Cancer

SAN CARLOS, Calif. and WASHINGTON – GO2 for Lung Cancer (GO2 for Lung Cancer) announced it will honor Daiichi Sankyo with the “Simply the Best Award” for their commitment to advancing lung cancer oncology discovery to meet the needs of all patients. The company will accept the award at the Simply [...]

Presidential Proclamation Designates November as National Lung Cancer Awareness Month

As we come together to commemorate Lung Cancer Awareness Month, we are excited to share that President and First Lady Biden who just issued a Presidential Proclamation designating November 2022 as National Lung Cancer Awareness Month! GO2 is honored to have partnered with the White House in developing this [...]

Advances in Precision Medicine for Late Stage Lung Cancer

Authors: Renee Botello, MSc., Treatment and Trials Navigator; Andrew Ciupek, PhD, Associate Director, Clinical Research; Chief Scientific Officer Jennifer C. King, PhD; Shanada Monestime, PharmD, BCOP, Director, Community Engaged Research Every person’s cancer is different, which is why we cannot use a one-size-fits-all approach to treatment. Precision medicine uses [...]

GO2 for Lung Cancer’s Presence at The World Conference on Lung Cancer 2022

Author: Brittney Nichols, MPH, BSN-RN, Specialist, Science and Research This summer, the World Conference on Lung Cancer convened in Vienna, Austria. GO2 shared our research with this community as both lead authors and collaborators on several projects to help advance the diagnosis, treatment, and survival of people with lung [...]

Advances in Treatment for Early Stage Non-Small Cell Lung Cancer

Author: Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program For many years, the treatment options given to patients diagnosed with early stage non-small cell lung cancer (NSCLC) was limited to surgery with or without chemotherapy to improve outcomes. However, like with metastatic NSCLC, the treatment landscape for patients with [...]

Jennifer Moran on Finding Inspiration – and Inspiring Others

Participating in research offers her hope of changing the course of lung cancer Jennifer Moran is married to her high school sweetheart. They have two teenage children in college. A photography major who once dreamed of working at National Geographic, she fell into “a wonderful career in ophthalmic photography.” [...]

GO2 for Lung Cancer’s Kathy Levy a Finalist for Prestigious Catalyst for Equity Award

We’re delighted to announce that Kathy Levy, GO2 for Lung Cancer’s ALCASE Project Manager, was a finalist for the prestigious C2 Catalyst for Equity award. The award recognizes people who have worked to overcome longstanding racial and ethnic disparities in cancer care, ensuring that all people have equitable access [...]

Living Room Recap – Options and Next Steps If Your Lung Cancer Becomes Resistant to Your Course of Treatment

What happens when your cancer becomes resistant to your course of treatment and progresses? That’s the question we explored in the September episode of our Lung Cancer Living Room series. Dr. David Gandara, professor emeritus and co-director of UC Davis Comprehensive Cancer Center’s Center for Experimental Therapeutics, discussed a [...]

Juanita Segura is Inspiring Hope in the Lung Cancer Community

Juanita Segura is a ray of hope in the fight against lung cancer. As a result, she has been awarded the 2022 Rays of Hope Award for her leadership and for inspiring hope as we work together as a community to conquer lung cancer. Upon receiving the award on [...]

Highlights from the World Conference on Lung Cancer

Authors: Andrew Ciupek, PhD, Associate Director, Clinical Research; Jennifer C. King, PhD, Chief Scientific Officer; Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program Doctors and scientists from around the world who are passionate about lung cancer convened last month to bring us the latest on the treatment landscape. GO2 [...]

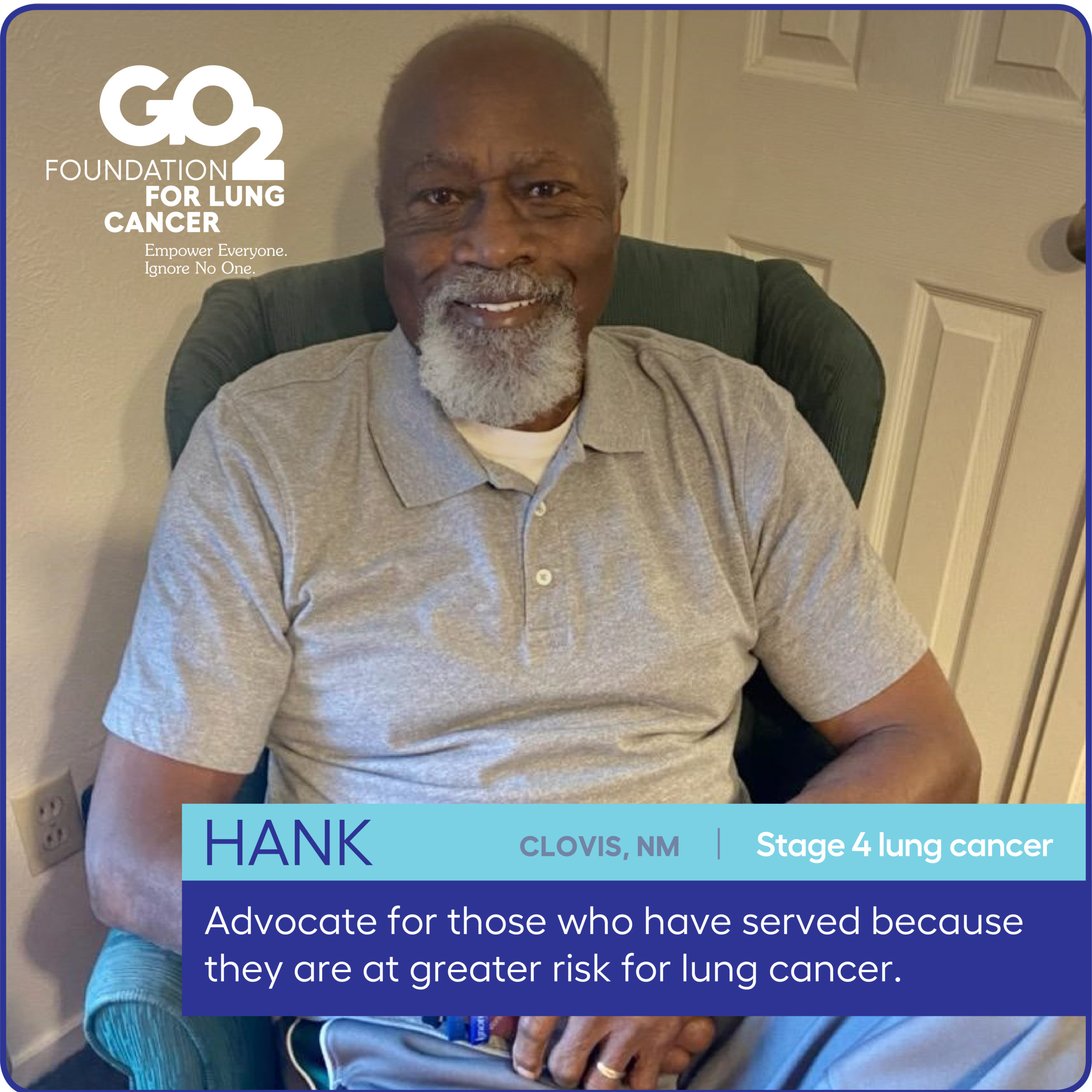

GO2 for Lung Cancer Receives Grant Award from Disabled Veterans National Foundation

Media Contact: Lori Millner Chief Marketing Officer lmillner@go2.org FOR IMMEDIATE RELEASE: Washington D.C. – September 15, 2022 GO2 for Lung Cancer is honored to announce it received a $25,000 grant from the Disabled Veterans National Foundation (DVNF). The grant will help fund its “Partners and Progress” program which works [...]

Living Room Recap – Reasons to be Optimistic About Small Cell Lung Cancer (SCLC)

Small cell lung cancer (SCLC) can be a highly aggressive form of lung cancer and can be difficult to treat. It is the rarest of the major lung cancer types and represents just 15% of all diagnoses. Unfortunately, few meaningful treatment advancements or improvements in survival rates have occurred [...]

Driving Change: Golf, Community and the Lung Cancer Cause

Curt Groebner is as passionate about golf as he is about fighting cancer. So passionate that for the last 12 years he has held a 24-hour golf marathon that has raised $88,982 for GO2. How a personal connection turned into an ongoing commitment “In our fourth year [of the [...]

FDA Approves First Targeted Therapy, Enhertu, for the Treatment of NSCLC With an Activating HER2 Mutation

On August 11th, 2022, the Food and Drug Administration (FDA) approved Enhertu (fam- trastuzumab deruxtecan-nxki) for treatment of advanced non-small cell lung cancer (NSCLC) with an activating HER2 mutation for patients who have received one prior line of therapy. The FDA based their approval on the results of the [...]

Victory for Veterans

We are humbled and proud to share that GO2 Senior Director Government Affairs Elridge Proctor, MPA, represented our community at the White House for President Joseph R. Biden’s signing of the “Honoring our PACT Act.” This is the most comprehensive act that will deliver vital care and benefits to [...]

New Survey Breaks the Silence on Women, Lung Cancer and Sexual Health

A groundbreaking new survey, conducted by a multi-disciplinary team in GO2 for Lung Cancer’s Lung Cancer Registry, found that sexual dysfunction is prevalent in women with lung cancer. The results were shared by study lead Dr. Narjust Florez (Duma) with top clinicians, researchers and scientists from across the world on [...]

GO2 for Lung Cancer Honors Dr. Rafael Rosell with the Bonnie J. Addario Lectureship Award

GO2 for Lung Cancer recognized Dr. Rafael Rosell at the 23rd International Lung Cancer Congress for his global contributions to oncology, particularly in the field of non-small-cell lung cancer (San Carlos, CA and Washington, DC) – GO2 for Lung Cancer has presented Dr. Rafael Rosell with the 2022 Bonnie [...]

Targeted Therapy Treatment Updates from ASCO 2022

Author: Andrew Ciupek, PhD, Associate Director, Clinical Research Targeted therapy research was front and center at the 2022 American Society of Clinical Oncology (ASCO) Annual Meeting. Data was presented from several studies detailing new targeted therapies and better understanding of how to treat non-small cell lung cancer (NSCLC) with [...]

New Treatments on the Horizon for Small Cell Lung Cancer

Author: Jennifer C. King, PhD, Chief Scientific Officer People diagnosed with small cell lung cancer (SCLC) have historically had limited treatment options—but researchers are working to change that. At the 2022 American Society of Clinical Oncology (ASCO) Annual Meeting, results from a few key studies were presented for the [...]

Immunotherapy Treatment Updates from ASCO 2022: Combinations, Resistance and More

Author: Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program Many patients with non-small cell lung cancer (NSCLC) rely on a class of treatments called immunotherapy to battle their cancer. The significant difference between immunotherapy and targeted therapy (the other main type of treatment that patients with NSCLC receive) is [...]

Coming Together for Equitable Cancer Care

Author: Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program One of the priorities of GO2 for Lung Cancer, alongside many other ally organizations, is to ensure that people diagnosed with lung cancer receive optimal care regardless of their background, socioeconomic status, race or ethnicity. Collectively, we’re working to break [...]

Treatments Beyond Surgery: Early-stage Options from ASCO 2022

Authors: Andrew Ciupek, PhD, Associate Director, Clinical Research and Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program People who are diagnosed with early stage (stage 1-2) non-small cell lung cancer (NSCLC) are generally broken down into two groups: those who can receive surgery to remove their tumor(s) and those [...]

Key Lung Cancer Takeaways from ASCO 2022

GO2 for Lung Cancer team pictured: Joelle Fathi, DNP, RN, ARNP, FAAN; Daniel Saez, MSc; Jennifer C. King, PhD By Jennifer C. King, PhD, Chief Scientific Officer and Daniel Saez, MSc, Manager, LungMATCH Navigation Program The American Society of Clinical Oncology (ASCO) Annual Meeting always features [...]

A Caregiver’s Evolution: From Shock to Engaged Advocate

By Kent Smith, lung cancer caregiver, advocate and GO2 for Lung Cancer Phone Buddy When my wife Debra was diagnosed with lung cancer in 2018, we were in shock. She had been having issues with her hip, which, after several weeks of physical therapy, didn’t resolve. An MRI revealed [...]

Four Takeaways from the 2022 Lung Cancer Voices Summit

Lung cancer advocates from across the country—and world—gathered virtually on May 16-17th at GO2 for Lung Cancer’s annual Lung Cancer Voices Summit. Participants learned about the latest research and treatment developments from experts in the field, received professional advocacy training and met with elected leaders to tell them lung [...]

Survivor Spotlight: Lindy A.

My name is Lindy Arman and I was diagnosed with small cell lung cancer (SCLC) in April 2020. I had recently had knee surgery which resulted in leg swelling that landed me in the emergency room. While there, they performed bloodwork which revealed extremely low sodium levels—which I now [...]

For Rachel Heimler, Summer Jam is a Family Affair

Summer Jam falls on Father’s Day weekend, which is just fine with Rachel Heimler. The first-grade teacher from Manhattan participates in honor of her father, Richard, who died of lung cancer in 2017. Running is Heimler’s jam, something she started doing during COVID to get outside and get some [...]

Tell Congress it’s Personal! Advocacy Day of Action is May 17th

These simple tools make sharing your lung cancer story easy and effective. On May 17th, hundreds of advocates from across the country will meet virtually with elected officials to advocate for the lung cancer community during the 2022 Lung Cancer Voices Summit. Whether you’re participating in the event or [...]

Statement on the passing of Norman Mineta GO2 for Lung Cancer Board Emeritus, Lung Cancer Survivor, former Transportation Secretary and Cabinet Member for Bill Clinton and George W. Bush

Our hearts are heavy as we mourn the passing of Norm Mineta, an extraordinary man, public servant and lung cancer advocate. As an Asian-American he overcame hardships and prejudices early in life to go on to serve at the highest levels of government. Beyond his long and respected career [...]

Small Cell Lung Cancer Transformation: What Is It and How Do We Treat It?

Author: Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program, GO2 for Lung Cancer People with lung cancer receiving treatment may encounter acquired drug resistance—a reduction in treatment effectiveness over time. Tagrisso (osimertinib) is currently a frontline treatment for people diagnosed with non-small cell lung cancer (NSCLC) with an EGFR [...]

Immune Checkpoint Inhibitor Resistance: What To Do Next?

Author: Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program, GO2 for Lung Cancer Immunotherapy, a type of treatment that helps the body’s own immune system fight cancer, is often discussed as a first line of treatment for people with metastatic non-small cell lung cancer (mNSCLC) without an actionable biomarker, [...]

New Screening Guidelines: How They Affect You and What You Need To Know

Authors: Andrew Ciupek, PhD, Associate Director, Clinical Research, GO2 for Lung Cancer; Anita K. McGlothlin, Senior Director, Economics & Health Policy, GO2 for Lung Cancer; Angela Criswell, MA, CPS, Director, Quality Screening and Program Initiatives, GO2 for Lung Cancer Lung cancer screening using low dose computed tomography (LDCT) is [...]

Considering Caregivers: The Lung Cancer Registry’s Newest Initiative

Authors: John Wells, MBA, Senior Specialist, Lung Cancer Registry; Jamie L. Studts, PhD, Professor of Medical Oncology and Scientific Director of Behavioral Oncology, University of Colorado School of Medicine; GO2 for Lung Cancer Scientific Leadership Board Member; International Caregiver Survey Working Group; Daniel A. Saez, MSc, Manager, LungMATCH Navigation Program, [...]

Young People Get Lung Cancer Too. We Need to Know Why.

“It took a total of about eight months, four or five doctors visits and multiple X-rays to eventually get that stage IV diagnosis.” -Stephen Huff, lung cancer survivor diagnosed at age 28 When you think about diseases impacting young people, lung cancer might not be at the top of [...]

Meet John: Behind the Scenes of the Lung Cancer Registry

John Wells, MBA-HA is the senior specialist on GO2 for Lung Cancer’s Lung Cancer Registry team. We sat down with John to talk about his role with the Registry, his experience as a health care professional and his advice for people living with lung cancer and their loved ones. My [...]

Survivor Spotlight: Marianne G.

My name is Marianne Gordon. In 2008, at 41 years old, I was rushed to the emergency room after passing out due to a collapsed lung. I had been seeing my doctor prior to this because my blood pressure kept mysteriously dropping which was attributed to some sort of [...]

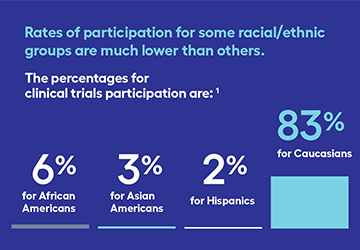

Breaking Barriers to Advance Inclusive Research

Clinical trials can help anyone—but did you know not all groups have equal representation? A clinical trial is a research study involving people to determine the effectiveness of a new therapy, or combination of therapies. Clinical trials offer people with lung cancer treatment options that might not otherwise be [...]

What Happens in Washington Sends Ripples Across the Land

Your participation in the Lung Cancer Voices Summit also impacts your local community. Sharing your story is an important way to help lawmakers and their staff to understand what it’s like to live with lung cancer—and why we need more research, more screening and more treatment options. That’s why [...]

The Power of Every Voice: Three Lung Cancer Advocates Share Advice for First-Timers

Lung cancer advocacy is about taking action and using your voice to drive lifesaving change. The best part? Anyone can do it. You don’t need to live in Washington, DC or know the ins and outs of Capitol Hill to speak up. Our annual Lung [...]

For Dr. Karen Arscott, “Lung Cancer Will Not Take My Present”

Dr. Karen Arscott has practiced medicine in a variety of venues, most recently caring for patients with substance use disorder. She’s also a two-time lung cancer survivor, a vocal advocate and a member of GO2 for Lung Cancer’s National Ambassador Council. Not initially [...]

Oncology Social Worker Brings Passion and Patients to the Lung Cancer Voices Summit

Kerri Susko, LISW-CP, OSW-C, MBCT Certified, was recruited to move to Prisma Health in Greenville, SC, when she joined the start-up team for the Center for Integrative Oncology and Survivorship. She provides individual psychotherapy to patients and family members. She’s also the Director of the Cancer Support Community at [...]

Walking Side by Side: A Call for Caregiver Support

By GO2 for Lung Cancer with Jamie L. Studts, PhD, Professor of Medical Oncology and Scientific Director of Behavioral Oncology, University of Colorado School of Medicine; GO2 for Lung Cancer Scientific Leadership Board Member; International Caregiver Survey Working Group Caregivers for patients with lung cancer offer vital support [...]